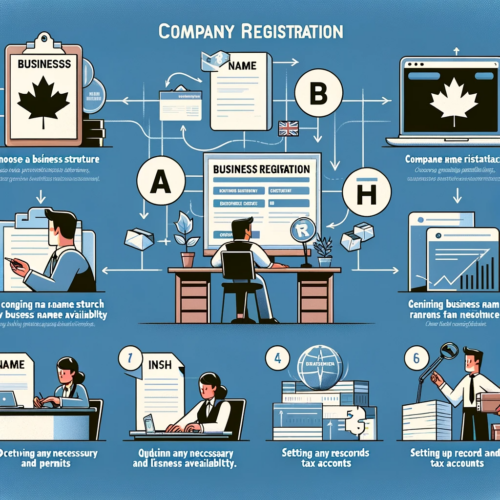

British Columbia Company Registration Price Details:

- Government Fees: $375 (including government fees and electronic application fee)

- CRA Business Number (BN): $25 (mandatory)

- Setting up Corporate Income Tax Account: $25 (mandatory)

- Service Fee: $138 (including preparation of standard signature documents and certificates as required by the government)

Due to policy changes, the Canadian government has stricter requirements and regulations for account holders. If you are not a Canadian citizen or a holder of valid permanent resident status, you need to register through a non-resident company tax number. After placing your order, we will provide you with relevant instructions.